Operating Results of the First Quarter of 2018

published: 15 May 2018

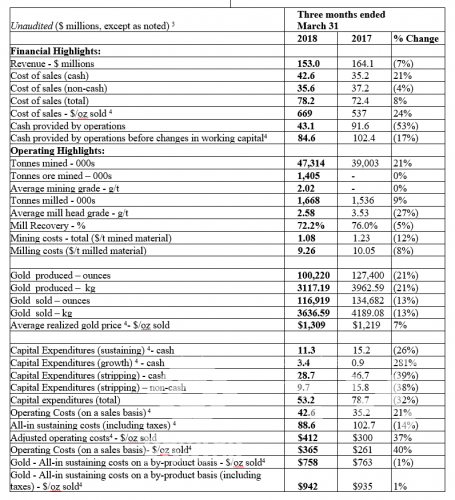

Centerra Gold Inc. (Centerra) and Kumtor Gold Company (KGC) have summed up their operating results in the first quarter of 2018. In the first three months of 2018, KGC produced 100,220 ounces¹ or 3117.19 kg of gold and contributed more than 2.23 billion soms in taxes and mandatory payments.

Gold Production and Sales

Kumtor produced 100,220 ounces of gold in the first quarter of 2018 compared to 127,400 ounces of gold in the same period of 2017. The decrease in ounces poured in the first quarter of 2018 is a result of processing the stockpiled ore from the Sarytor pit which is lower grade and more metallurgically complex, as compared to the stockpiled ore processed from cut-back 17 in the comparative period of 2017.

Gold sales in the first quarter of 2018 were 116,919 ounces, or 3.64 tonnes. Total revenues from gold sales in the first quarter of 2018 were $153.0 million2.

The Dore bars produced by the Kumtor mine are purchased by Kyrgyzaltyn JSC for processing at the Kara-Balta refinery pursuant to a Gold and Silver Sales Agreement signed by KGC, Kyrgyzaltyn and the Government of the Kyrgyz Republic. Kyrgyzaltyn JSC enjoys the exclusive right to sell refined gold and silver both within and outside the Kyrgyz Republic.

Operating costs and All-in Measures:

Operating costs (on a sales basis), including capitalized stripping, decreased in the first quarter of 2018 by $10.6 million to $ 71.3 million compared to $81.9 million in the same period of 2017. The movements in the major components of operating costs (mining, milling and site support), including capitalized stripping but before changes in inventory, is explained below:

Mining Costs, including capitalized stripping (First Quarter 2018 compared to First Quarter 2017):

Mining costs, including capitalized stripping, totaled $51.1 million in the first quarter of 2018, which was $3.4 million higher than the comparative quarter in 2017. Increased costs for first quarter of 2018 includes higher diesel costs ($5.3 million), which was due to higher consumption resulting from an increase in tonnes mined and higher fuel prices, as well as higher labour costs ($0.8 million) mainly due to unfavorable exchange rate fluctuation. Higher costs were partially offset by lower maintenance costs ($2.6 million) resulting from increased work on the Hitachi shovels and haul trucks conducted in the first quarter of 2017, as compared to the first quarter of 2018.

Milling Costs (First Quarter 2018 compared to First Quarter 2017):

Milling costs amounted to $15.5 million in the first quarter of 2018 compared to $15.4 million in the comparative quarter of 2017. Higher mill reagent costs ($0.7 million) were mainly due to increased processed tonnes in the mill. This was offset by lower liner costs ($0.7 million) resulting from liner replacements in March 2017, which replacements were not performed during the first quarter of 2018.

Site support Costs (First Quarter 2018 compared to First Quarter 2017):

Site support costs in the first quarter of 2018 totalled $12.9 million compared to $10.7 million in 2017. The increase is attributable primarily to higher costs for food supplies and other miscellaneous costs.

Operating Results

1 – One Troy ounce equals to 31.103 48 grammes.

2 – Unless specified otherwise, all dollar figures in this news release are in US dollars.

3– Numbers may not add up due to rounding

4- Non-GAAP measures and are discussed under “Non-GAAP Measures” in Centerra’s MD&A and news release dated May 1, 2018.

5- Financial extracted from Centerra’s news release.

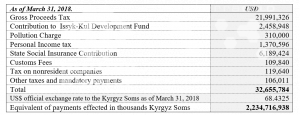

2018 Payments to the Kyrgyz National Budget and Mandatory Contributions

During the first three months of 2018, contributions to the national budget in taxes, deductions to the Social Fund and other mandatory payments have totaled 2.23 billion soms.

Note: Under the Agreement on New Terms dated as of April 24, 2009, the revenue-based tax and contributions to the Issyk-Kul Region Development Fund are estimated based on actual cash revenues from sales during the period under review.

Outlook for 2018

Kumtor’s 2018 gold production forecast is expected to be in the range of 450,000 to 500,000 ounces with about 45% of the gold production expected in the fourth quarter. In 2018, Kumtor’s all-in sustaining cost on a by-product basis is expected to be in the range of $733 to $815 per ounce sold. At Kumtor, 2018 total capital expenditures, excluding capitalized stripping, are forecast to be $63 million. Spending on sustaining capital of $49 million relates primarily to major overhauls and replacements of the heavy duty mine equipment ($42 million). Growth capital investment at Kumtor for 2018 is forecast at $14 million primarily related to tailings dam construction ($9 million). The cash component of capitalized stripping costs related to the development of the open pit is expected to be $122 million of the $168 million total capitalized stripping estimated for 2018.

CEO Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “I am pleased to report that the roll-out of our Work Safe – Home Safe program has been fully embraced across the organization and we are now embarking on our drive to zero harm within the work place. We are seeing the early benefits of this safety program where on April 11th, 2018, our Kumtor operation achieved a significant milestone of one full year and 6 million man-hours without incurring a lost time injury.”

The Kumtor open pit mine, located in the Kyrgyz Republic, is one of the largest gold mines in Central Asia operated by a Western-based gold producer. It has been operating since May 1997 and has produced over 11.6 million ounces or 360 tonnes of gold to March 31, 2018.

Kumtor Gold Company is the operator of the Kumtor Project responsible for the entire production cycle.

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties in North America, Asia and other markets worldwide, and is the largest Western-based gold producer in Central Asia. Centerra operates two flagship assets, the Kumtor Mine in the Kyrgyz Republic and the Mount Milligan Mine in British Columbia, Canada and is building its third gold mining operation, the 100%-owned Öksüt Gold Mine in Turkey. Centerra’s shares trade on the Toronto Stock Exchange (TSX) under the symbol CG. The Company is headquartered in Toronto, Ontario, Canada.

The Kyrgyz Republic, via Kyrgyzaltyn JSC, is Centerra’s largest shareholder owning 77,401,766 common shares. As of May 15, 2018, Kyrgyzstan’s interests were estimated at $443 million.

Additional information on Centerra and the full text of the news release on the first quarter 2018 are available on SEDAR at www.sedar.com and the corporate websites at www.centerragold.com and www.kumtor.kg.

For further information, please contact Media Relations, KGC, media@kumtor.com

Tel: (312) 90-07-07; 90-08-08; fax: (312) 90-07-28

– End –