2020 FOURTH QUARTER AND 2020 YEAR-END RESULTS

published: 12 March 2021

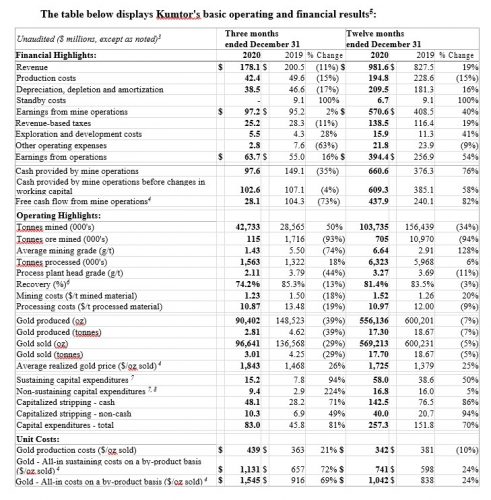

Basic Operating and Financial Results

In 2020, Kumtor’s gold production was 556,136 ounces¹ or 17,297.76 kg of gold from previously mined on-surface stockpiled ore, compared to 600,201 ounces or 18,668.35 kg of gold produced in 2019. The decrease in gold production in 2020 was primarily due to lower process plant head grade and lower gold recovery coming from the stockpiled ore. During 2020, Kumtor’s average process plant head grade was 3.27 g/t with a recovery of 81.4% compared to 3.69 g/t and a recovery of 83.5% in 2019.

During the fourth quarter of 2020, Kumtor’s gold production was 90,402 ounces from on-surface stockpiled ore compared to 148,523 ounces of gold produced in the fourth quarter of 2019. The decrease was primarily due to lower average process plant head grades and lower gold recovery. During the fourth quarter of 2020, Kumtor’s average process plant head grade was 2.11 g/t with a recovery of 74.2% compared to 3.79 g/t and a recovery of 85.3% in the fourth quarter of 2019.

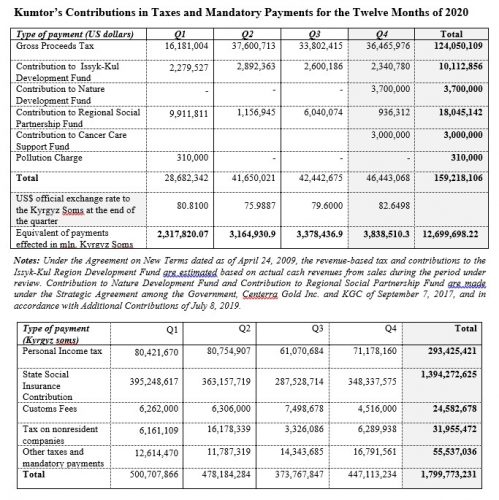

Contribution to the national budget in taxes and mandatory payments in 2020 is 14.5 billion soms.

The Dore bars produced by the Kumtor mine are purchased by Kyrgyzaltyn JSC for processing at the Kara-Balta refinery pursuant to the Restated Gold and Silver Sales Agreement, dated June 6, 2009 between KGC, Kyrgyzaltyn and the Government of the Kyrgyz Republic. Kyrgyzaltyn JSC enjoys the exclusive right to sell refined gold and silver both within and outside the Kyrgyz Republic.

COVID-19 update

Kumtor continues to implement mitigation controls and health & safety precautions at the mine site to contain the spread of COVID-19. As previously disclosed, open pit mining was operating at below capacity in July, returned to full capacity in September and continued at full capacity through the fourth quarter. Mill processing operated at full capacity throughout the year.

Lysii waste dump update

In July 2020, Kumtor received a permit to utilize the Lysii Valley for dumping waste rock going forward. Lysii Valley is expected to be the main mine waste rock dump for the next two years as it is closest to cutback 20. According to the new waste dumping plan in the Lysii Valley, waste rock will be placed at the base of the valley initially and the waste rock dump will be developed up the valley creating slightly longer haulage distances in the near-term.

2021 Kumtor Technical Report Update

In February 2021, the Company issued a new technical report for the Kumtor mine, as at July 1, 2020 (the “2021 Kumtor Technical Report”), extending its mine life to 2031 and increasing its reserves 107% (1) to 6.3 million contained ounces of gold (73.3 million tonnes at an average gold grade of 2.66 grams per tonne gold (g/t Au) using a gold price of US$1,350 per ounce).

The 2021 Kumtor Technical Report provides an update of the 2015 technical report, including a mineral resource model update based on extensive in-fill and expansion drilling in recent years. The 2021 Kumtor Technical Report also revised the gold price assumptions, pit slope angles, capital and operating cost estimates and metallurgical recovery estimates based on process plant improvements, all of which has resulted in updated mineral resource and mineral reserve estimates, a revised ultimate pit design and an updated mining plan. The technical report was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and filed on SEDAR on February 24, 2021 with an effective date of July 1, 2020.

- Reserve increase calculated by comparing the new 2021 Kumtor Technical Report effective as at July 1, 2020 compared to the December 31, 2019 reserve statement (less mine depletion from January 1, 2020 to June 30, 2020).

- One Troy ounce equals to 31.10348 grammes.

- Unless specified otherwise, all dollar figures in this news release are in US dollars.

- Numbers may not add up due to rounding

- Non-GAAP measure. See discussion under “Non-GAAP Measures” in Centerra’s news release dated February 24, 2021.

- Financial data extracted from Centerra’s news release dated February 24, 2021.

- Metallurgical recoveries are based on recovered gold, not produced gold.

- Capital expenditures are presented on a cash basis.

- Non-sustaining capital expenditures are distinct projects designed to have a significant increase in the net present value of the mine. In the current year, non-sustaining capital expenditures included additional costs related to cut-back 20.

Production

In 2020, Kumtor finished mining cut-back 19 and continued stripping and managing the ice from cut-back 20. Tonnes mined were 103.7 million tonnes in 2020 compared to 156.4 million tonnes in 2019. The decrease was primarily due to the suspension of mining operations from December 2019 to mid-January 2020, longer haulage distances as a result of the change in the waste dump location from the Lysii Valley to the Central Valley for the first half of the year and lower equipment utilization due to workforce availability (primarily COVID-19 related). Of the 103.7 million tonnes mined in 2020, 101.6 million tonnes were capitalized as waste stripping for benefit of future production from cut-back 20.

During the fourth quarter of 2020, Kumtor continued mining cut-back 20. Tonnes mined were 42.7 million in the fourth quarter of 2020 compared to 28.6 million tonnes in the fourth quarter of 2019. The increase was due to the suspension of mining operations in December 2019 due to the Lysii waste rock dump incident. The 42.7 million tonnes mined in the fourth quarter of 2020 were capitalized as waste stripping for the benefit of future production from cut-back 20.

Gold production costs in 2020 were $342 per ounce compared to $381 per ounce in 2019. The decrease was primarily due to increased tonnes processed, partially offset by lower grades and recovery.

In the fourth quarter of 2020, gold production costs were $439 per ounce, compared to $363 per ounce in the fourth quarter of 2019. The increase was primarily due to lower ounces sold.

Mining Costs

During 2020, mining costs were $1.52 per tonne compared to $1.26 per tonne in 2019. The increase was primarily due to lower tonnes mined, and longer haulage distances, partially offset by lower diesel fuel prices, lower maintenance costs and a favourable foreign currency exchange rate movement.

Mining costs in the fourth quarter of 2020 were $1.23 per tonne compared to $1.50 per tonne in the fourth quarter of 2019. The decrease was primarily due to greater tonnes mined and lower diesel fuel prices. Total mining costs were $52.4 million of which $48.1 million was capitalized in the fourth quarter of 2020, compared to $42.8 million in mining costs of which $28.2 million was capitalized in the fourth quarter of 2019.

Processing costs per tonne

Processing costs were $10.97 per tonne in 2020 compared to $12.00 per tonne in 2019. The decrease was primarily due to increased tonnes processed and lower maintenance costs as a result of less maintenance activities performed due to COVID-19.

Processing costs were $10.87 per tonne in the fourth quarter of 2020 compared to $13.48 per tonne in the fourth quarter of 2019. The decrease was primarily due to 18% greater tonnes processed and lower maintenance costs.

All-in Sustaining and All-in Costs4

During 2020, all-in sustaining costs on a by-product basis, which excludes revenue-based tax were, $741 per ounce compared to $598 per ounce in 2019. The increase was mainly due to higher capitalized stripping costs, fewer ounces sold, higher sustaining capital representing the purchase of eleven haulage trucks to increase mining capacity and higher Strategic Agreement contributions to the various regional funds in the Kyrgyz Republic. This was partially offset by lower production costs.

All-in costs on a by-product basis were $1,042 per ounce in 2020 compared to $838 per ounce in 2019. The increase was due to an increase in all-in sustaining costs on a by-product basis and greater revenue-based taxes paid as a result of higher gold prices.

All-in sustaining costs on a by-product basis, which excludes revenue-based tax, were $1,131 per ounce in the fourth quarter of 2020 compared to $657 per ounce in the fourth quarter of 2019. The increase was primarily due to fewer ounces sold, an elevated level of capitalized stripping costs as mining activities were concentrated on stripping cut-back 20 and greater sustaining capital costs relating to rebuilds and haul truck fleet expansion, partially offset by lower production costs.

All-in costs on a by-product basis were $1,545 per ounce in the fourth quarter of 2020 compared to $916 per ounce in the fourth quarter of 2019. The increase was due to an increase in all-in sustaining costs on a by-product basis and the purchase of haul trucks to support the mine expansion.

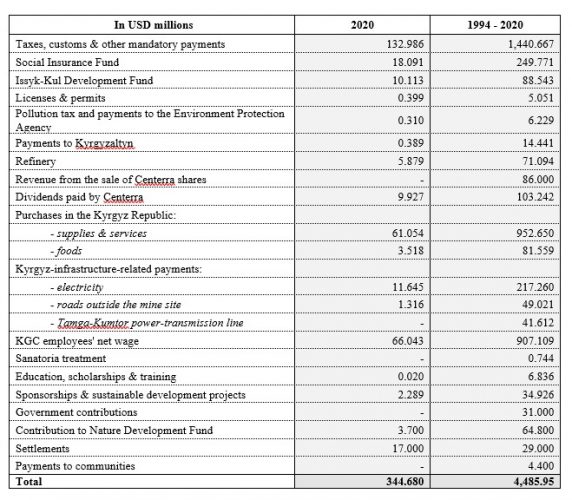

Payments within the Kyrgyz Republic

Contributions made within the Kyrgyz Republic in 2020 (including taxes, refining, domestic suppliers, infrastructure, charities, etc.) have exceeded US $ 344.680 million2. In all, contributions made within the Kyrgyz Republic between 1994 and 2020 have exceeded US $ 4.48 billion.

Kumtor’s Impact on the Macroeconomic Performance of the Kyrgyz Republic

According to preliminary reports of the Kyrgyz Republic National Statistics Committee,

- Kumtor’s share in Kyrgyz Republic’s GDP in 2020 was 5%;

- Kumtor’s share in the aggregate industrial output was 3%.

Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “Kumtor had another strong year where gold production was at the top end of guidance delivering 556,136 ounces of gold at an all-in-sustaining cost on a by-product basis of $741 per ounce sold, which was lower than the low-end of its all-in-sustaining cost guidance.”

“During the year, the Company repaid its debt and ended the year with no debt and cash of $545.2 million. In January 2021, we completed the sale of our 50% interest in the Greenstone Gold Mines Partnership and received a cash payment of approximately $210 million (including adjustments) adding to our strong balance sheet.”

“Based on the Company’s financial position, recent strong operating results and cash flows, the Board approved a quarterly dividend to CAD$0.05 per share on February 23, 2021.”

“The updated Kumtor Mine Technical Report was filed on SEDAR on February 24, 2021, showcasing an extended mine life for Kumtor. The new Kumtor life-of-mine adds significantly to the open pit reserves and has extended Kumtor’s mine life by 5 years. The new mine life is 11 years and milling operations are extended to 2031. The new life of mine plan has consistent annual gold production averaging 590,000 ounces for 5 years commencing in 2022 at an average life of mine all-in sustaining costs on a by-product basis of $828 per ounce sold.”

The Kumtor open pit mine, located in the Kyrgyz Republic, is one of the largest gold mines in Central Asia operated by a Western-based gold producer. It has been in production since 1997 and has produced over 13.2 million ounces of gold to December 31, 2020.

Kumtor Gold Company is the operator of the Kumtor Project responsible for the entire production cycle.

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties in North America, Asia and other markets worldwide and is one of the largest Western-based gold producers in Central Asia. Centerra operates three mines, the Kumtor mine in the Kyrgyz Republic, the Mount Milligan mine in British Columbia, Canada and the Öksüt mine in Turkey. Centerra’s shares trade on the Toronto Stock Exchange (TSX) under the symbol CG. The Company is based in Toronto, Ontario, Canada.

The Kyrgyz Republic, via Kyrgyzaltyn JSC, is Centerra Gold’s largest shareholder owning 77,401,766 common shares. As of March 12, 2021, Kyrgyzstan’s interests were estimated at $ 772 million.

Additional information on Centerra Gold Inc. and the full text of the news release on the 2020 Fourth Quarter and 2020 Year-end Results are available on SEDAR at www.sedar.com and the corporate websites at www.centerragold.com and www.kumtor.kg.

________________________________________________________________________________

For further information, please contact Media Relations, KGC.mediа@centerragold.com

Tel: (312) 90-07-07; 90-08-08; fax: (312) 90-07-28

– End –