Operating Results of the First Quarter of 2020

published: 13 May 2020

Centerra Gold Inc. (Centerra) and Kumtor Gold Company (KGC) have summed up their operating results in the first quarter of 2020. In the first three months of 2020, KGC produced 152,307ounces¹ or 4737.28 kg of gold and contributed more than 2.82 billion soms in taxes and mandatory payments.

Gold Production and Sales

In the first quarter of 2020, Kumtor produced 152,307 ounces of gold from stockpiles, compared to 150,308 ounces of gold in the same prior year period. The increase in the current quarter was primarily due to higher gold recovery and more gold produced from carbon fines, partially offset by lower grades. During the first quarter of 2020, Kumtor’s average process plant head grade was 3.5 g/t with a recovery of 83.7% compared to 3.7 g/t and a recovery of 82.0% in the first quarter of 2019.

Gold sales in the first quarter of 2020 were 160,090 ounces, or 4,979.36 kilograms. Total revenues from gold sales in the first quarter of 2020 were US$248.9 million2.

The Dore bars produced by the Kumtor mine are purchased by Kyrgyzaltyn JSC for processing at the Kara-Balta refinery pursuant to a Gold and Silver Sales Agreement signed by KGC, Kyrgyzaltyn and the Government of the Kyrgyz Republic. Kyrgyzaltyn JSC enjoys the exclusive right to sell refined gold and silver both within and outside the Kyrgyz Republic.

Recent Developments

In view of, among other things, the urgent need for regional development in the Kyrgyz Republic, Kumtor Gold Company determined that additional contributions to the previously established Kyrgyz Republic Social Partnership for the Regional Fund were appropriate. Accordingly, it made a further $9 million contribution to the Regional Fund in March 2020 and intends to make further contributions of $2.2 million each quarter the mine is in operation, up to a total of $22.0 million.

On February 15, 2020, an employee fatality occurred at Kumtor when an excavator slipped down into a water-filled basin near the edge of Petrov Lake, which is situated five kilometres northeast of the Kumtor mill site. An internal investigation was conducted, and management collaborated closely with the Kyrgyz regulators and other state authorities to ascertain the cause of the incident.

On December 1, 2019, Kumtor experienced a significant waste rock movement at the Lysii waste rock dump, resulting in two employee fatalities. The Company initiated an emergency evacuation of all mine personnel from the area and an immediate cessation of mining operations. In January 2020, after an extensive search and in consultation with the families of the deceased Kumtor employees, search efforts were terminated. In late January 2020, after significant analysis of its procedures, including safety procedures, and consultation and approval of the relevant the Kyrgyz Republic state agencies, the Company recommenced mining operations, placing waste rock materials on the Central Valley waste rock dump after receiving approvals for its revised 2020 mining plans. Currently, Kumtor is not permitted to place waste rock materials at the Lysii waste rock dump as was contemplated in the initial 2020 mine plan.

A normal course updated Kumtor Technical Report is expected to be completed in the second half of 2020.

COVID-19 update

During the first quarter of 2020, with the support of the Kyrgyz Republic Government, Kumtor has implemented a number of proactive measures to prevent the spread of COVID-19 such as extending mine site crew rotations, separating key process plant personnel from mining crews, increasing health hygiene protocols, maintaining social distancing to ensure the safety of its employees, contractors, communities and other stakeholders, as well as, to try to ensure the uninterrupted flow of its supply chain to ensure the continuation of operations. Despite the strict restrictions imposed by the Government of the Kyrgyz Republic on the movement of people and goods within the country, the Government has been supportive of Kumtor’s continued operations.

1 – One Troy ounce equals to 31.103 48 grammes.

2 – Unless specified otherwise, all dollar figures in this news release are in US dollars.

3– Numbers may not add up due to rounding

4- Non-GAAP measures and are discussed under “Non-GAAP Measures” in Centerra’s MD&A and news release dated May 1, 2020.

5- Financial data extracted from Centerra’s news release dated May 1, 2020.

First Quarter 2020 compared to First Quarter 2019

For the three months ended March 31 2020, Kumtor recorded greater revenue and earnings from mine operations of 28% and 37%, respectively, when compared to the same prior year period. The increase was primarily due to 20% higher average realized gold price and 7% more ounces sold in the first quarter of 2020 compared to the first quarter of 2019.

Cash provided by mine operations in the first quarter of 2020 was $134.3 million, $14.3 million more than the same prior year period due to greater revenue, partially offset by a decrease in cash from working capital due to a larger increase in accounts receivable and an increase in payments made for taxes. Free cash flow4 in the first quarter of 2020 was $95.6 million compared to $91.6 million in the first quarter of 2019. The increase was due to an increase in cash provided by mine operations, partially offset by an increase in capitalized stripping costs.

During the first quarter of 2020, after restarting mining operations in January following the Lysii waste rock dump incident, Kumtor finished mining cut-back 19 West and the SB Zone and continued stripping and unloading ice from cut-back 20.

Tonnes mined were 20.0 million compared to 49.2 million tonnes in the comparative prior year period, representing a decrease of 59%, mainly due to the suspension of operations from December 2019 to January 2020 and longer haulage distances as a result of the Company’s inability to use the Lysii waste rock dump. Of the 20.0 million tonnes mined in the first quarter of 2020, 18.0 million tonnes were capitalized as waste stripping for future production from cut-back 20. Kumtor is currently utilizing the Central Valley waste rock dump in accordance with the revised and approved 2020 mining plan.

Mining costs, including capitalized stripping, were $35.4 million in the first quarter of 2020 compared to $51.3 million in the first quarter of 2019. Lower mining costs in the first quarter of 2020 is attributable to the suspension of mining operations in January.

Processing costs were $17.4 million in the first quarter of 2020 compared to $17.2 million in the prior year period, due primarily to increased costs associated with higher carbon fine processing, partially offset by lower reagents costs because of processing low oxidized ore.

Site support costs in the first quarter of 2020 were $10.0 million compared to $11.8 million in the same period of 2019, due to lower labour costs as a result of a favourable movement in the local currency exchange rate and lower camp and contractor costs due to continuous improvement initiatives.

Kumtor’s production costs per ounce of gold sold were $322 for the first quarter of 2020, compared to $360 in the first quarter of 2019. The decrease was primarily due to an increase in ounces sold and a decrease in production costs as a result of higher silver sales and higher capitalized stripping.

Kumtor’s all-in sustaining costs on a by-product basis per ounce sold4, which excludes revenue-based tax, were $644 per ounce in the first quarter of 2020 compared to $553 per ounce in the same prior year period. The increase was mainly due to higher capitalized stripping costs and a $9 million contribution to the Kyrgyz Republic Regional Fund, partially offset by an increase in ounces sold.

Including revenue-based taxes, all-in sustaining costs on a by-product basis per ounce sold4 were $864 per ounce in the first quarter of 2020 compared to $735 per ounce in the same prior year period.

Exploration Update

The drilling program for 2020 includes 55,000 metres of exploration and 15,000 metres of infill drilling, which are focused on priority and high potential targets. Primary targets include various zones of the Central, Southwestern and Sarytor pits where a recently updated Kumtor resource block model, based on enhanced geological modelling and positive drilling results between 2018 and 2019, demonstrated substantial growth in measured, indicated and inferred mineral resources.

In addition, exploration drilling is expected to resume in the underexplored segments of the Kumtor Gold Trend – the NE Targets, Bordoo, Akbel and conceptual targets (Hope Zone and others).

During the first quarter of 2020, exploration drilling programs continued with the completion of fifty-three diamond drill holes for 13,816 metres and eighteen reverse circulation (RC) drill holes for 2,037 metres. Exploration drilling focused on testing zones of sulfide and oxide mineralization near the surface for additional open pit resources, at the corridor between the Central and Southwest pits (Hockey Stick and Kosholuu zones), on the periphery of the Sarytor Pit, Northeast targets, Muzdusuu area and also on the northeast side of the Central Pit.

Drill collar locations and associated graphics are available at the following link:

Qualified Person & QA/QC – Exploration

Exploration information and other related scientific and technical information in this document regarding the Kumtor Mine were prepared in accordance with the standards of NI 43-101 and were prepared, reviewed, verified and compiled by Boris Kotlyar, a member with the American Institute of Professional Geologists (AIPG), Chief Geologist, Global Exploration with Centerra, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used and quality assurance-quality control protocols used during the exploration drilling programs are done as described in the Kumtor Technical Report dated December 31, 2014. The Kumtor deposit is described in the 2019 Annual Information Form and the Kumtor Technical Report, which are both filed on SEDAR at www.sedar.com.

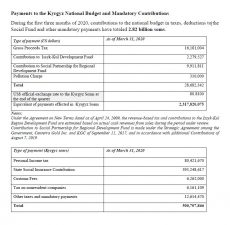

Payments to the Kyrgyz National Budget and Mandatory Contributions

During the first three months of 2020, contributions to the national budget in taxes, deductions to the Social Fund and other mandatory payments have totaled 2.82 billion soms.

Commentary

Scott Perry, President and Chief Executive Officer of Centerra stated, “During the current outbreak of COVID-19, we are consciously taking the necessary precautionary measures to prevent the spread and ensure the health, safety and well-being of our employees, contractors and communities. We have also celebrated a recent safety milestone, when on April 19, 2020, our Öksüt Mine achieved one year without a lost time injury. Our continued commitment to Work Safe Home Safe is a driving force behind achieving such milestones.” “The strong operating performance at Kumtor and Mount Milligan in the fourth quarter of 2019 has carried over into the first quarter of 2020. These two operations delivered consolidated gold production of 185,988 ounces at all-in sustaining costs4 on a by-product basis of $712 per ounce sold in the quarter. Kumtor had another strong quarter producing 152,307 ounces of gold production at all-in-sustaining costs4 on a by-product basis of $644 per ounce sold.” “During the quarter, Kumtor continued to operate at its planned production rates, with the process plant continuing to operate at approximately 18,000 tonnes per day processing stockpiled ore. In response to COVID-19, the site has extended the crew rotation schedule from the usual two-week rotation up to four weeks, replacement crews are brought in early and segregated; they are thoroughly screened prior to a crew change and the various crews are separated by department when on site.”

Kumtor Mine

The Kumtor open pit mine, located in the Kyrgyz Republic, is one of the largest gold mines in Central Asia. It has been in production since 1997 and has produced over 12.8 million ounces of gold to March 31, 2020.

Kumtor Gold Company is the operator of the Kumtor Project responsible for the entire production cycle.

About Centerra

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold properties in North America, Asia and other markets worldwide and is one of the largest Western-based gold producers in Central Asia. Centerra operates two flagship assets, the Kumtor Mine in the Kyrgyz Republic, the Mount Milligan Mine in British Columbia, Canada and now has a third operating gold mine, the 100%-owned Öksüt Mine in Turkey, which began production in January 2020. Centerra’s shares trade on the Toronto Stock Exchange (TSX) under the symbol CG. The Company is based in Toronto, Ontario, Canada.

The Kyrgyz Republic, via Kyrgyzaltyn JSC, is Centerra Gold’s largest shareholder owning 77,401,766 common shares. As of May 13, 2020, Kyrgyzstan’s interests were estimated at $ 694 million.

Additional information on Centerra Gold Inc. and the full text of the news release on the First Quarter 2020 is available on SEDAR at www.sedar.com and the corporate websites at www.centerragold.com and www.kumtor.kg.

For further information, please contact Media Relations, KGC.mediа@centerragold.com

Tel: (312) 90-07-07; 90-08-08; fax: (312) 90-07-28

– End –