Results of the Second Quarter of 2011

published: 17 August 2011

Results of the Second Quarter of 2011

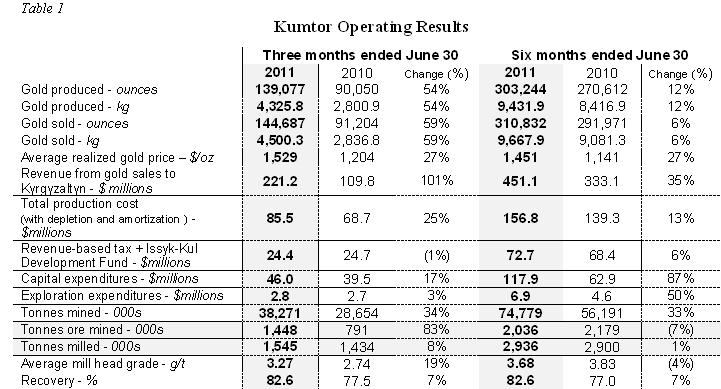

Centerra Gold Inc. (TSX: CG) and Kumtor Operating Company (KOC) have summed up the results of the second quarter of 2011. During the period between April and June 2011, Kumtor produced 139,077 ounces¹ or 4,325.8 kg of gold. Since the beginning of 2011, the Kumtor mine has produced 303,244 ounces, or approximately 9,432 kg, of gold.

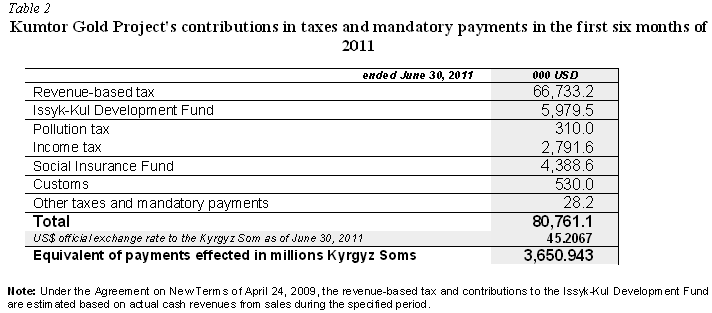

During the first six months of 2011, it has contributed more than Soms 3.65 billion in taxes and mandatory payments to the Kyrgyz Republic.

Gold Production and Sales

At the Kumtor mine in the Kyrgyz Republic, gold production was 139,077 ounces in the second quarter of 2011 representing a 54% increase from the same quarter in 2010.

The increase in gold production is the result of higher grades and higher recoveries in the second quarter of 2011. The mill head grade averaged 3.27 g/t with a recovery of 82,6% in the second quarter of 2011, compared to 2.74 g/t with a recovery of 77,5% in the same quarter of 2010. Ore tonnage processed increased 7.7% to 1.5 million tonnes in the quarter compared to 1.4 million tonnes in the same period of 2010.

Revenue in the second quarter of 2011 increased to $221.2 million2 from $109.8 million in the second quarter of 2010 primarily as a result of the higher sales volumes (144,687 ounces in the second quarter of 2011 compared to 91,204 ounces in the same period of 2010) and an increased average realized gold price. The average realized price in the second quarter 2011 was $1,529 per ounce compared to $1,204 per ounce in the same period of 2010.

Gold produced by the Kumtor mine is purchased at the mine site by Kyrgyzaltyn for processing at its refinery in the Kyrgyz Republic pursuant to a Gold and Silver Sales Agreement signed by KOC, Kyrgyzaltyn and the Government of the Kyrgyz Republic.

Production Cost and Capital Expenditures

In the second quarter of 2011, total production cost, including depreciation and amortization, was $85.5 million compared to $68.7 million during the same period of 2010.

Capital expenditures in the second quarter of 2011 were $46.0 million, compared to $39.5 million in the same quarter of 2010. Sustaining capital of $8.0 million in the second quarter of 2011 was predominantly spent on the major overhaul program for heavy duty equipment ($5.1 million), tailings dam lift ($1.5 million) and other projects ($0.6 million).

Growth capital investment during the second quarter of 2011 totalled $38.0 million which was mainly spent on pre-stripping capitalization ($15.1 million), purchases of the new CAT 789 haul trucks ($11.0 million), underground development ($9.7 million), underground delineation drilling ($0.5 million), purchase of container handler for Balychy Marshalling Yard ($0.5 million) and numerous other projects ($1.2 million). Other production-related figures are given in Table 1.

Exploration

Exploration expenditures totaled $2.8 million for the second quarter of 2011, comparable to the same quarter in 2010.

During the second quarter of 2011, exploration drilling programs continued in the Kumtor Central Pit, regional exploration drilling continued on the Kumtor concession area at the Northeast, Petrov, Bordoo and Akbel areas and surface exploration commenced on the Karasay and Koendy projects.

A complete listing of the drill results and supporting maps for the Kumtor pit have been filed on the System for Electronic Document Analysis and Retrieval (‘SEDAR’) at www.sedar.com and can be viewed using the following link at http://file.marketwire.com/release/CCG728a.pdf and are available at the Company’s web site at: www.centerragold.com.

Underground Development

The underground development at Kumtor continued in the second quarter of 2011 with a total advance of 490 metres. Year-to-date total development advance is 891 metres. Decline #1 (SB Zone decline) advanced 193 metres in the second quarter and is now approximately 1.5 kilometres in length

Decline #2 advanced 153 metres in the second quarter towards the SB Zone and totals 807 metres in length. The Stockwork Drive advanced 144 metres in the second quarter to a total length of 429 metres.

In the Stockwork Drive, delineation drilling commenced in the second quarter and exploration drilling continues to test for extensions to the Stockwork Zone. Delineation drilling of the SB Zone is planned for the first quarter of 2012.

Outlook for 2011

The Kumtor mine is expected to produce 550,000 to 600,000 ounces, or 17.1 to 18.6 tonnes, of gold in 2011.

Kumtor’s total cash cost for 2011 is expected to be $430 to $460 per ounce produced, which is unchanged from the prior guidance.

During 2011 total capital expenditures at Kumtor are forecast to be $205 million, which includes $169 million of growth capital and $36 million of sustaining capital.

Growth capital will be spent primarily on the purchase of seven CAT 789 haul trucks ($21 million), purchase of remaining equipment for the North Wall expansion project ($28 million), pre-strip costs related to the development of the open pit ($62 million), a waste dump expansion project ($3 million) and other projects. Also, $52 million is included in growth capital investment for the underground.

The largest sustaining capital spending will be on the major overhaul maintenance of the heavy duty mine equipment ($19 million), expenditures for the shear key, buttress and tailings dam construction works ($5 million) and for equipment replacement and other items ($12 million).

Planned exploration expenditures in the Kyrgyz Republic in 2011 are approximately $13 million.

Payments to the KR National Budget and Mandatory Contributions

During the first six months of 2011, contributions to the Kyrgyz Republic’s national budget in taxes as well as those to the Social Fund and other mandatory payments totaled $80,761,000. According to the official National Bank exchange rate as of June 30, 2011, this is more than Soms 3.65 billion compared to Soms 3.45 billion in the same period of 2010. (See Table 2).

Other Corporate Developments

On June 23, 2011 Centerra held its Annual Special Meeting of Shareholders. At the Shareholders Meeting all resolutions proposed by management were voted in favour of. The number of directors elected at the Meeting was twelve.

As previously disclosed (see Centerra’s news release of July 11, 2011), Centerra announced a significant discovery in Eastern Mongolia at its Altan Tsagaan Ovoo (ATO) property. It is viewed as a new emerging mineral district. The 35 additional drill holes completed in June continue to demonstrate high-grade mineralization from surface and that there is good continuity in the mineralization.

As indicated in Centerra’s earlier news release, the Board has approved a $6 million increase in the Centerra’s 2011 exploration budget from $34 million to $40 million, with $4 million of this additional funding allocated for further work on the ATO property.

Commentary

Robert Wunder, President of Kumtor Operating Company, stated, “We are satisfied with another solid quarter of operating performance at our mine and will maintain our gold production and cost guidance for the year.”

* * *

The full text of Centerra Gold Inc.’s news release is available at:

http://www.thepressreleasewire.com/client/centerra/release.jsp?year=2011&actionFor=1478745&releaseSeq=0

The Kumtor open pit mine, located in the Kyrgyz Republic, is the largest gold mine in Central Asia operated by a Western-based gold producer. It has been operating since May 1997 and so far has produced more than 8 million ounces, or 252 tonnes, of gold.

Kumtor Operating Company is a wholly-owned subsidiary of Centerra Gold Inc. and is the operator of the 100% owned Kumtor project. KOC is responsible for the entire production cycle.

Centerra Gold Inc. (Centerra) is a North American-based gold mining company focused on operating, developing, exploring and acquiring gold properties primarily in Asia, the former Soviet Union and other emerging markets worldwide. Centerra is the largest Western-based gold producer in Central Asia. Centerra’s shares trade on the Toronto Stock Exchange (TSX) under the symbol CG. The Company is based in Toronto, Canada.

Kyrgyzaltyn JSC is Centerra’s largest shareholder holding approximately 33% of the outstanding common shares (77,401,766 common shares). As of August 15, 2011, the value of Kyrgyzaltyn’s interest exceeded $1.5 billion.

Additional information on Centerra as well as the full text of Centerra’s news release about the Second Quarter Results are available on SEDAR at www.sedar.com and the Company’s website at www.centerragold.com.

_________________________________

(1) One Troy ounce equals to 31.1034768 grammes.

(2) Unless specified otherwise, all dollar figures in this news release are in US dollars.

For further information please contact Media Relations, KOC

Tel: (312) 90-07-07; 90-08-08; fax: (312) 90-07-28

the end